Bene ira rmd calculator

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If inherited assets have been transferred into an inherited IRA in your name.

Required Minimum Distributions Tax Diversification

Beneficiary IRA Distribution Calculator This calculator helps you assist an IRA beneficiary in calculating the amount heshe is required to withdraw each year from the inherited IRA.

. Compare 2022s Best Gold Investment from Top Providers. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value. Change the year to calculate a previous years RMD.

Use this calculator to determine your Required Minimum Distributions. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required. If you are age 72 you may be subject to taking annual withdrawals known as.

If you were born on or after. But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply. This guide may be especially helpful for those with over 500K portfolios.

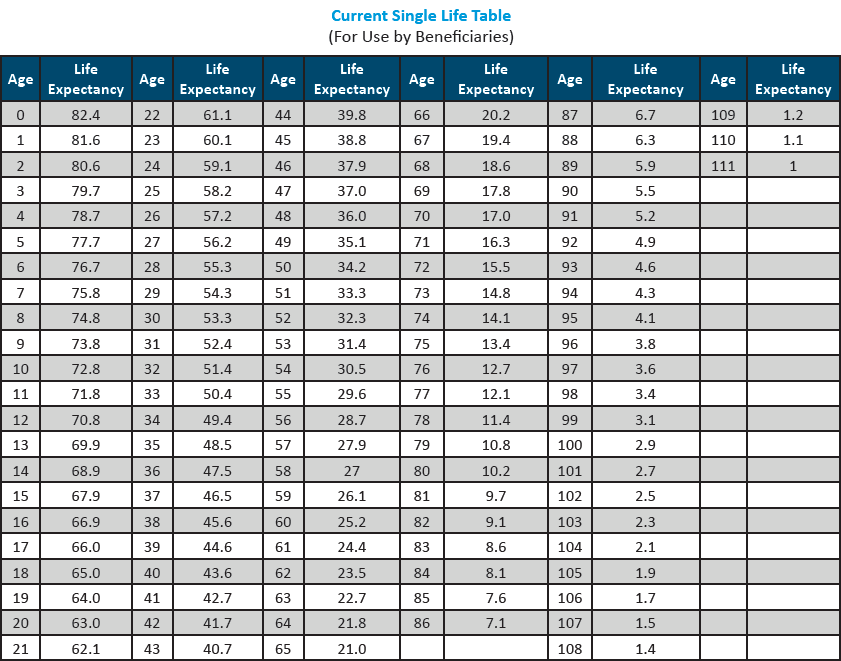

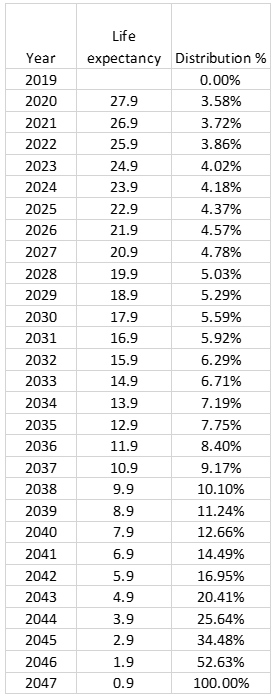

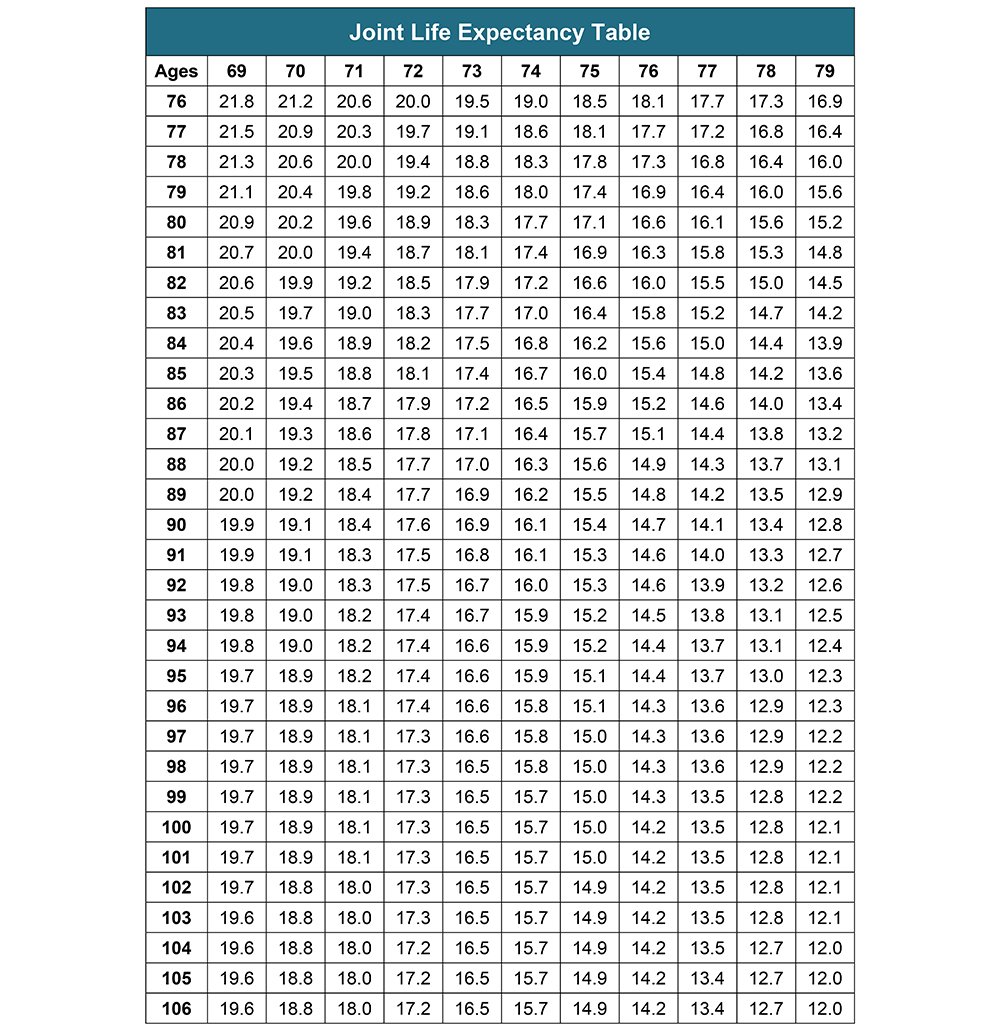

Determine beneficiarys age at year-end following year of owners. This is typically the current year. Beneficiary RMD Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account.

You must take an RMD for the year. Beneficiary Date of Birth mmddyyyy. This calculator is undergoing maintenance for the new IRS tables.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. Yes Spouses date of birth Your Required Minimum. Learn How Edward Jones Can Help.

Calculate your earnings and more. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year. Understand What is RMD and Why You Should Care About It.

The SECURE Act of 2019 changed the age that RMDs must begin. IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the. Find a Dedicated Financial Advisor Now.

Run the numbers to find out. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Get your own custom-built calculator.

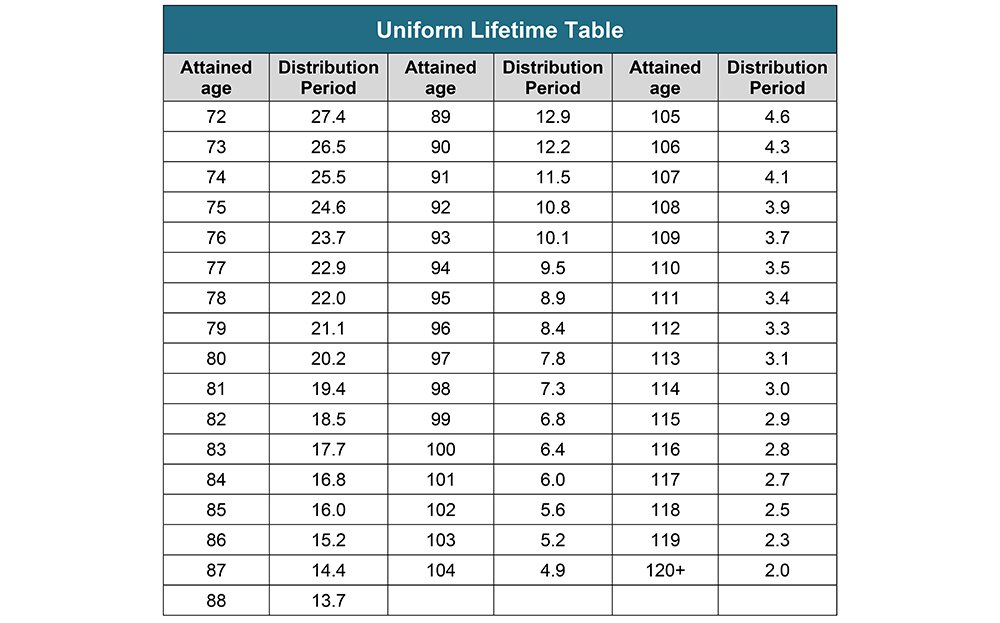

Inherited RMD calculation methods The date of death of the original IRA owner and the type of beneficiary will determine what distribution method to use. Ad Whats Your Required Minimum Distribution From Your Retirement Accounts. IRA Required Minimum Distribution RMD Table for 2022.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

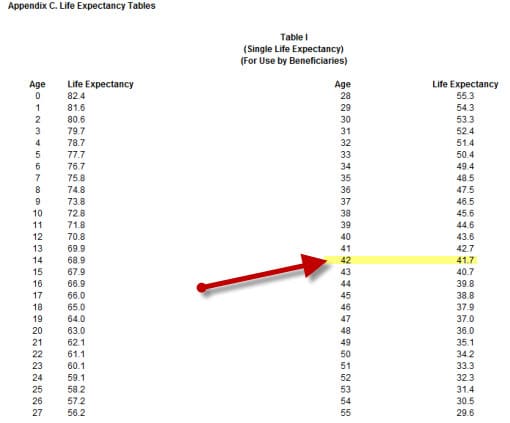

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Reviews Trusted by Over 45000000. Do Your Investments Align with Your Goals.

Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. Discover Fidelitys Range of IRA Investment Options Exceptional Service. The 10-year rule applies regardless of whether the participant dies before on or after the required beginning date RBDthe age at which they had to begin RMDs.

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. If inherited assets have been transferred. For assistance please contact 800-435-4000.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad What Are Your Priorities. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Distribute using Table I. New Look At Your Financial Strategy. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

The year to calculate the Required Minimum Distribution RMD. As a beneficiary you may be required by the IRS to take. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. We offer bulk pricing on orders over 10 calculators. Generally for individuals or employees with accounts who die prior to January 1 2020 designated beneficiaries of retirement accounts and IRAs calculate RMDs using the.

Beneficiarys name Please enter the. With Merrill Explore 7 Priorities That May Matter Most To You. Ad If you have a 500000 portfolio download your free copy of this guide now.

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Your Search For The New Life Expectancy Tables Is Over Ascensus

Required Minimum Distributions Rules Heintzelman Accounting Services

Rmds Tis The Season For Required Minimum Distributions

Required Minimum Distribution Calculator

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Your Search For The New Life Expectancy Tables Is Over Ascensus

Sjcomeup Com Rmd Distribution Table

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

The Inherited Ira Portfolio Seeking Alpha

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Rmd Tables

Required Minimum Ira Distributions Tax Pro Plus

Your Search For The New Life Expectancy Tables Is Over Ascensus